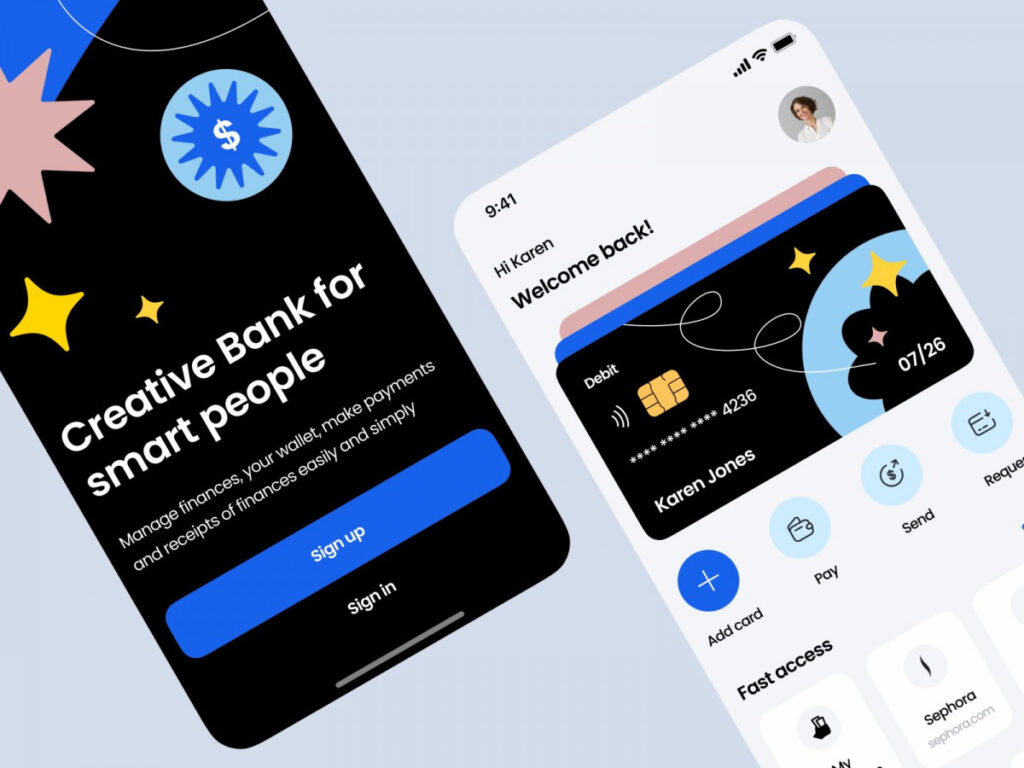

If you could keep only one app on your smartphone, it would probably be your bank’s app. Mobile banking has many benefits, and more people are using it every day. By 2025, about 217 million people in the US will use digital banking. So, what makes a good mobile banking app? Let’s explore the key features it should have.

Basic Features of A Mobile Banking App

If you want to create a digital banking app, you need to know which features are important. Most users look for basic banking functions that are easy to use. Here are six must-have features for any mobile banking app.

Easy Account Statements

One main reason people use banking apps is to check their account balance. Over 90% of users check their money and view their transaction history through the app. This feature should allow users to see their expenses in real-time. It’s even better if they can download their statements in formats like PDF or CSV for sharing.

Inter-Account Transfer

Many users have multiple accounts, like checking and savings. An inter-account transfer feature lets them move money easily between these accounts and pay credit card bills without visiting a bank. Users should be able to select accounts, enter the amount, and confirm the transaction. The app should also show a clear confirmation.

Person-To-Person Transfer

P2P transfers let users send money to friends or family. This feature is great for splitting bills and makes money transfers quick and easy. The more options the app offers for transferring money, the more users will enjoy it.

Online Bill Payments

People want apps that simplify their lives. A bill payment feature allows users to pay bills quickly and set reminders for upcoming payments. Some apps even let users set up automatic payments for regular bills or split bills with family members.

ATM Locator

This helpful feature shows users where to find ATMs, especially when they need cash. Users can search for nearby ATMs and find those with no fees. While it may seem small, it can be a big advantage.

Adaptable User Interface

A good app is not just about features but also about how it looks and works. A simple and clear design is essential. Users should find it easy to navigate and access their favorite features. The app should also work well on smartphones, tablets, and laptops.

Security Mobile Banking App Features

Many people avoid banking apps due to security concerns. It’s vital to address these fears. Here are some important security features:

Two-Factor Authentication

2FA adds an extra security step by requiring users to provide another form of identification, like a code sent to their phone. This makes it harder for unauthorized users to access accounts.

Biometric Authentication

This feature uses unique physical traits, like fingerprints or facial recognition, to verify identity. It provides a secure way for users to log in and should also allow for backup authentication methods.

Account Use Warnings

These alerts notify users of any unusual account activity, helping to protect against fraud. Users can customize what types of activities they want to be alerted about.

Innovative Features of Mobile Banking App

To stand out, a banking app should offer innovative features. Here are some ideas:

Crypto-Assets Integrations

This rare feature lets users manage their cryptocurrency investments within the banking app. It simplifies tracking and trading cryptocurrencies.

QR Code Payments

With QR code payments, users can easily make transactions without needing a physical card. They scan a code, confirm the payment, and the transaction is completed.

AI-Powered Chatbots

Chatbots can answer common questions and assist users with banking tasks, improving customer support and engagement.

ATM Withdrawal Without a Card

Users can withdraw cash by generating a unique code in the app, making it easier and faster to access cash without a card.

Gamification

Making banking fun through challenges, rewards, and badges can engage users. This feature can also include financial literacy games to help users learn about money management.

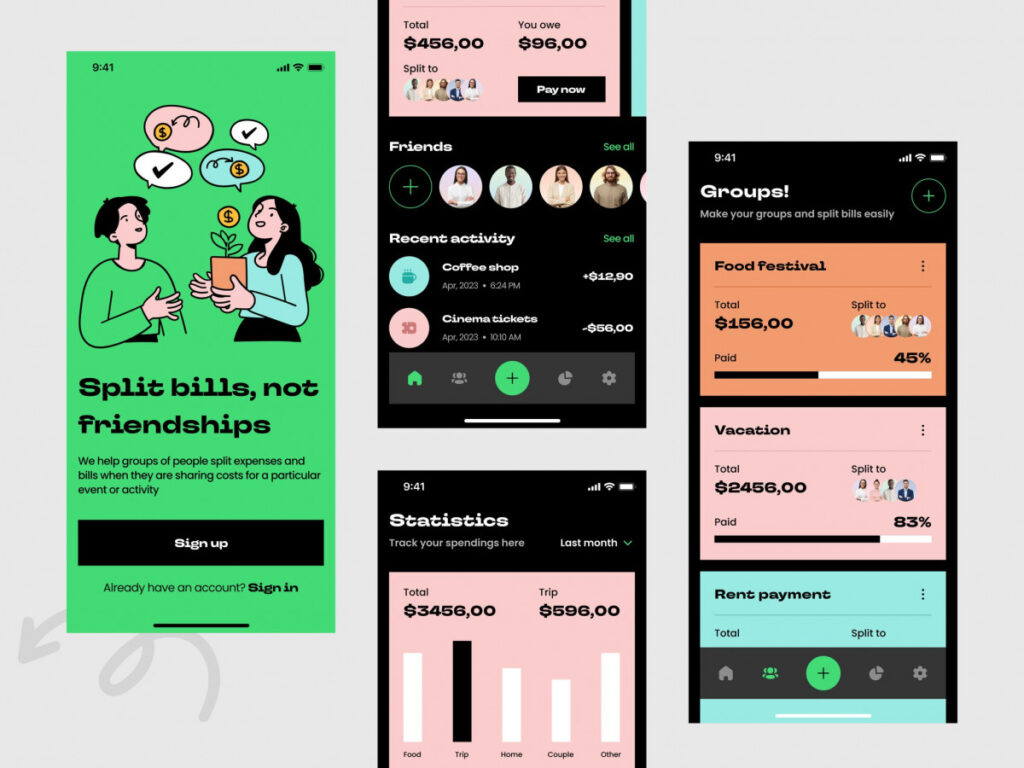

Shared Finances

This feature is great for families or roommates to track shared expenses. Users can invite others to join and set permissions for account access.

Stomcrafts Expertise in Innovative Mobile Banking App Development

At Stomcrafts, we understand the importance of staying current in digital banking. We provide complete design and development services for banking apps, ensuring they include the latest features like biometric authentication and AI chatbots.

Conclusion

Mobile banking is essential and is here to stay. Customers want secure, user-friendly apps with innovative features. As the industry grows, more apps will appear, and some will succeed while others won’t. If you’re thinking about creating a mobile banking app, partner with FireArt Studio. We have the expertise to help you succeed.